|

Attorney Steven Bush asks, “But let me get this straight. Okay, because I want to make sure that everybody's clear. So you, when you, representing the insurance company, went to the policyholder's house. You viewed the damage yourself. You wrote a scope of the damages and estimated the damages, and then you send it in. And then they changed your scope to represent the insurance company's guidelines? And that’s the scope that they represent. They left your name on it, is that correct?” Independent adjuster on a laptop screen responds, “Yes.” Do Insurance Companies Ever Doctor Claims Estimates?We're in between episodes of The DYOJO Podcast. So we wanted to share three things with you. 1. What We're Working On - the Lessons Learned from Storm Response and Hurricane Recovery workshop with G. Pete Consigli, CR, WLS 2. In The News - At least 21 independent adjusters are acting as whistleblowers calling out insurance companies for doctoring estimates. Including clips of Attorney Steven Bush interviewing whistleblowers from insurance companies after Hurricane Ian in southwest Florida. 3. One More Tidbit - A preview of some content we are developing for the issue of matching materials for insurance claims. This includes snippets from our conversation with Bill Wilson, David Princeton, and an unnamed independent adjuster. What We're Working On: Storm Response WorkshopWhat are we working on? At The DYOJO we're always writing. We're always working on something. But there is one big thing I want to make sure everyone is aware of because the clock is ticking. Pete Consigli, the Global Restoration Watchdog, and Jon Isaacson are teaming up to put a one-day workshop together. This is called Lessons Learned from Storm Response and Hurricane Recovery.

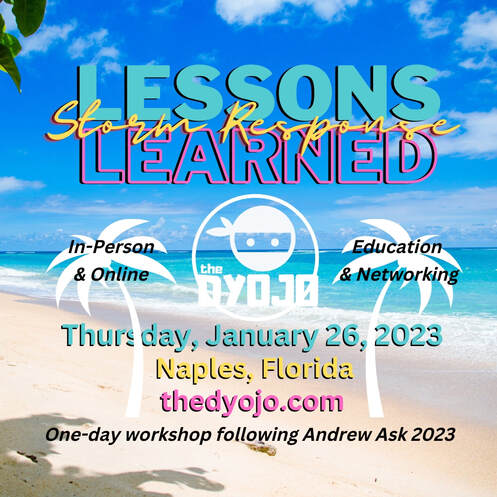

WHAT: Lessons Learned from Storm Response and Hurricane Recovery, one-day workshop WHERE: In-person, Hilton Naples, Florida; Remote, Zoom WHEN: Thursday, January 26, 2023 730am – 530pm EST REGISTRATION: In-person and online tickets available until 1/25/23 at 5pm EST, early bird discounts until 1/19/23 at 5pm EST – Workshop Eventbrite This will be right after the Andrew Ask Building Science Symposium (aka Winter Break 2023), which is on that Tuesday and Wednesday of January 25th and 26th. Andrew Ask will feature a historic four-person panel The Pioneers of Building Science. This panel is something that's been in the works for a long period of time. This group of building science pioneers is going to be together and likely may not all be together at the same event like this gain. If you want a full week's worth of education and networking, heed the advice of Bob Blochinger, “Come here and have a lot of fun and gain some education.” For those in Naples, the Monday prior to the Andrew Ask event, Pete and I are working on a meet and greet collaboration called the Moisture Mob Neighborhood. We’re going off a Mr. Rogers Neighborhood vibe and bringing the old dogs, the watchdogs, the moisture mob, and members of the restoration industry’s history, together with the up and coming restorers. We want to connect professionals from all disciplines and generations that have a passion for doing things the right way. Those that want to know about the history of the industry and carry that forward. You can’t beat the weather in Florida. It's one of the Snowbird destination spots and I've not been to that side of Florida so I'm looking forward to it. Looking forward to hanging out with Pete Consigili, Cliff Zlotnik, Randy Rapp, Charlie Casani, and more. We've got the agenda posted on The DYOJO webpage. You can look at the list of speakers and the panel presentations. We have early bird discounts going through the 19th of January. There is in-person attendance if you want to travel to Florida or plan to be in Florida for Andrew Ask. There will also be remote participation via Zoom with early bird discounts for that. So, whether you want to watch that by yourself, or gather the office together and view it as a team, I think there's gonna be a lot of really useful information. This workshop is timely given the series that we've been working on at The DYOJO Podcast. We’ve been reviewing Robert Jordan Construction (RJC) versus Arlington Independent School District (AISD). This is a case where a contractor assisted on a Winter Storm Uri loss in 2021. The contractor felt they had to sue in order to get their money. But as we've been pulling back the curtains by digging into the court documents, there's definitely some lessons to be learned on both parties and things that maybe could have kept them out of litigation and got them a lot closer to the number that they were hoping for. How To Suck Less At Estimating is Now an Online CourseThe DYOJO is excited to announce that our best-selling book How To Suck Less At Estimating: Habits For Better Project Outcomes is now available as an online course. This six-module course is available through our friends at Restoration Technical Institute. If you sign up for the course, you get a free PDF copy of the book that is designed to correspond with the learning materials. In The News: Insurance WhistleblowersI believe I first heard of this story from Insurance Journal, where independent adjusters charge Florida insurers with doctoring damage estimates. What's interesting, as much as contractors often complain about some of the third-party administrators (TPAs), the insurance adjusters, a lot of the ones that we talk to complain as well. These programs are supposed to solve the communication piece. It should, in theory, help us get to a quicker agreed-upon scope and initial cost so the ball can keep rolling for repairing the structure. This doesn't always happen. I would like to be the first to say:

Everybody has a bit of fault in that we're working with this imperfect process. But what is coming down the pipe or seems to be increasing is this doctoring issue. The majority of these are related to storms. I believe this was testimony before the Florida House of Representatives. But there seems to be particular shenanigans, anywhere where there's more storm activity. In the Whistleblower video the participants talk about a tile roof estimate where the independent adjuster, a licensed independent adjuster, physically went to the property, assessed the damage themselves on behalf of the insurance company, and believed that all or the majority of the roof needed to be replaced. Then the carrier representative - or I apologize not the carrier representative but the program representative - the third party administrator changed the estimate. Many people have brought up often these TPA representatives are not licensed adjusters. They're not licensed public adjusters, but they're implementing guidelines without ever having been to the property and overriding the independent adjuster. Some of you may not understand that there are:

An independent adjuster doesn’t always have the authority of a captive adjuster, but they do have the training and the licensing. As they talk about in the Whistleblower video, they have the documentation to support what they believe is the proper extent and remedy for damages. So before I get too far into the weeds, let's let's listen in. I found this video on the Hurricane Ian Show on YouTube. It says Whistleblower Insurance Adjusters Describe Fraudulent Activity on Hurricane Ian Claims. If you're watching the video, the person that we're first viewing straight ahead appears to be attorney Stephen Bush, who is conducting the interviews. There's a gentleman sitting at the left who appears to be the same person in the Insurance Journal article on the front of that article. They're interviewing another couple of adjusters on the computer. This appears to be a video produced by the American Policyholder Association known as the APA. And they are policyholder advocates. Attorney Steven Bush asks, “So you guys were working these claims you were visiting with the policyholders. You were looking at their damages, writing their estimates and so on. Why don't you tell us what happened after that.” Independent adjuster, “So I began submitting the claims. And it’s understandable it took a while for the files to begin being reviewed. I noticed on my first claim that was reviewed, I received notification from Xactanalysis, which is the system that runs our estimating system, that a file had been “collaborated”. And I thought that was odd, because usually what happens is that if somebody wants to change an estimate, the reviewer will reach out to us directly and ask us to make changes. We can discuss if the changes are necessary or not. So I went into the claim. And this claim was, this particular claim was a tile roof with substantial damage to it. Therefore, I estimated to replace the entire roof. However, the collaboration that the reviewer changed the estimate to reflect replacing 499 tiles, which I thought was really unusual.” This matching issue I think is going to become more and more of an issue, especially if the economy gets tighter. I think that's one of the areas insurance companies are going to tighten in because it's it's an area of ambiguity. We see matching, they mentioned roofing, siding, flooring is another big one, cabinets, countertops, those kinds of things. I think these roles and responsibilities are important for the members of the Restoration Triangle:

We call this The DYOJO Insurance Claims Standard as outlined most of our books (see video). The insured should say, “Wait a minute, that's not what was explained to me when I purchased the insurance policy.” The should get their local insurance agent involved. If the claims process and holdouts are really not making sense, then they might have to escalate things further. But this “collaboration” issue where someone, the carrier or the TPA, changes the estimate, of the contractor or the independent adjuster, but leaves the other parties name on it, that's potential for getting the estimator in trouble. It’s not a line that should be crossed. Independent adjuster, “The changed estimate is no longer my estimate because I didn't change it. So obviously, I was upset and asked him about it. And his response was that well, they change the estimates in order to reflect the carrier guidelines.” Attorney, “So the company you're working for told you that they were we're changing your estimates so that your estimates reflected the carrier's guidelines.” IA, “Correct.” Attorney, “But what about the damage?” IA, “I completely agree with that implication. Right, the damage was, was still there. So I called Mark and I said, ‘Hey, have you noticed that?’ Because he was working before I was and he said let me check and he checked and the conversation was that they were changing his estimates as well. I didn't have a conversation with Dan but I knew that Mark knew him and had that conversation too.” IA #2, “There's a photo report where we've sent in, where we show the damage on the other report, to support what we wrote. And you know, we looked together and we pulled it up and sure enough you know, there were changes made to just about all on this thing, its amazing.” Attorney, “Let me get this straight. Okay, because I want to make sure that everybody's clear. So, you representing the insurance company, went to the policyholder's house, you viewed the damage yourself. You wrote a scope of the damages and estimated the damages, then you send it in and then they changed your scope to represent the insurance company's guidelines, and that scope that they represent the left journey Come on it. Is that correct?” IA, “Yes.” Attorney, “And then when they left your name on it, the scope that they were presenting to the policyholder did not reflect the proper damages that was sustained from the storm. Is that correct?” Okay, so if this gets your blood temperature raising. Apparently, the lawsuit that kicked this off was brought by SFR Services, a South Florida restoration firm. They claimed to have text messages from United desk adjusters and other company personnel than instructed field adjusters to avoid estimating wind damages altogether. To downplay damages and damage estimates for hundreds of claims or to add false information. Of course, the representation from Universal said this is absolutely not the case. According to an article from Insurance Journal, Universal attorney, Travis Miller stated that the company simply has never in its history had a practice of alternating manipulating or doctrine independent adjusters reports for delivery to insurance. He suggested that the adjusters had confused Universal with United Property and Casualty Insurance, which was a defendant in a lawsuit this year that alleged similar actions by United employees. To some degree, I can see the insurance company saying, “No, that was the third-party administrator (TPA). We weren't aware of this was happening.” But these are direct lawsuits with the carriers. So this is where it gets interesting. “It’s extremely widespread,” said Mark Boardman, president of Claims Management Services Inc., based in Maitland, Florida. “Can I prove it? No. But I have had a lot of anecdotal conversations with adjusters about it.” So, it's a lot of people talking around it. But a federal judge in October dismissed the suit from SRS Services noting that federal law leaves it to states to regulate the insurance business. A similar suit is now pending in state court in Martin County. In an article from our friends at Claims Pages that links to Repair Driven News, says that there are two related lawsuits, one dismissed and the other pending, had been filed over this issue in Florida. The first was the one we mentioned with SFR Services, the restoration firm out of South Florida, against United Property and Casualty Insurance. That one the federal court kicked back to the state. But the second, Mandel and Vinson are now working with Attorney Stephen Bush. That's the video we showed you. Bush told the Insurance Journal he plans to file a class action lawsuit against property insurers over the allegedly altered adjuster reports. Bush said 21 independent adjusters have come to him and are expected to be part of the lawsuit. Criminal charges may also result from this process, the adjusters told the Insurance Journal. That will be interesting to keep an eye on for sure. As for the whistleblower video, if an insured is having issues with their insurance company this might be one to share. I think you could be playing with fire, so be sure you know what you are doing. For example, just because someone doesn't like a line item that you used or doesn't completely agree with your scope doesn't mean that they're in bad faith or committing fraud. I hope those that are listening will take this in the broader picture, I think there's instances and customers where this might be relevant. Something to understand and be aware of is this “collaboration” mechanism. If the carrier is changing the estimate it is now their estimate and they need to put their name on it, not the estimators. One More Tidbit: Matching Materials for Insurance ClaimsIf you're a contractor, this case is one to watch. In my mind, the roofing scenario that the independent adjuster brought up in the whistleblower video is one that's been on my radar. We've been preparing our team and I've been thinking through how to cross that bridge when we come to it with insurance. If it's in the policy, and that's what the customer signed up for, there's not a lot to say about that. If it's ambiguous, there's going to be issues as the insurance companies tighten their grip. So that's our One More Tidbit, we're going to look a little bit at matching materials for insurance claims and talk about some conversations that are coming up later this year. I think insurance policyholders and contractors, need to ask more questions such as, “Can you please clarify in the policy where it states your position on matching?” In my opinion, I think it’s tied to the economy. If the economy continues to go down, this materials matching issue is going to be an area where they sharpen their pencils. Information from an unnamed independent adjuster, “I sent you that file. I mean, if there's no match, I don't see why it wouldn't start trending that direction. And if they're trying to cut corners or cut costs, what was reported to me is that vendors are being told if we want more work then we’ve got to follow their new guidelines.” This is something that we'll include in a later episode. But this is a conversation, an independent adjuster reached out to The DYOJO Podcast here on the West Coast, just so you can't say, well, that's just a Florida thing. So here's a small clip, we've distorted the voice to protect the innocent. IA, “Sure, guidelines are basically designed to cut costs. And so as a third party, you know, if you want business, you’ve got to do their bidding. But then they can point the finger back at us as the ones choosing to write the estimates the way they are. So it's hard as an independent. We're not. We don't really have any control of what we adjust. Otherwise, if we write anything outside of the box, it will be rejected. So we're trained to write inside the box. And when they change the box, we're forced to write stuff that we may not agree with.” The DYOJO, “Stuff that's traditionally been covered?” IA, “Right.” Its important to understand what matching is as it relates to that particular policy. If the policy doesn't spell it out, that ambiguity should fall to the policyholder. We recorded with Bill Wilson, author of When Words Collide and David Princeton from Advocate Claim Service, so we'll get that out later this coming year. David Princeton, “Replacement cost has to mean something more than just putting a new shingle in, right? And you know, now we have repairability standards and other things have evolved as they've gotten more complicated. That patchwork roof, let's say it's an acceptable repair. But that's where they said no replacement cost, you’ve got to put it all back. Because you're restoring the value, restoring the loss of that value to that property. That's kind of the framework that I look at for these things. I look at the principle of indemnity and the contrast between actual cash value (ACV) and replacement cost (RCV). Right? If I have a replacement cost policy and not an actual cash value policy, that's where your promise has to be broader.” Bill Wilson, “If you look up ever took like INS 21 it'll say what is a loss and they get the answer. The definition is loss or reduction in value. Value can mean many things. When we think of value it includes the cost to rebuild. Replaced includes the market value and exactly what you're talking about. In auto insurance, the concept is diminished value. A car that's been wrecked, even if it's rebuilt perfectly, is still worth less than a car that's never been wrecked even though functionally and appearance wise everything is identical. It's that mental perception that people have of a willing buyer and seller that it's not worth what it would have been if it wasn't in a wreck. So, every insurance company puts a provision in the policy where they don't cover diminished value. You can have a few shingles replaced or the whole roof, but it's going to cost you. So, is everybody willing to pay double the premium to have that coverage? And if so, why not provide it?” Stay Tuned With The DYOJO PodcastOn our last episode of The DYOJO Podcast, we talked about two court cases. One case where the contractor did well in understanding the agreement and documenting what they did and prevailed in court. The other is the one that we've been talking about at length RJC versus AISD, where it's a lot more ambiguous and that caused a lot more problems.

So we're going from those two litigation scenarios back into our RJC discussion. We're going to be reviewing how that relates to data for moisture documentation. We're going to review some moisture mapping with Josh Winton, we're going to review some moisture strategies with Cliff Zlotnik. We're also going to talk how that intersects with your agreement and lack of documentation with Bebo Crain. RECAP What did we learn today?

So, go forth and do good things. We're here to help you shorten your DANG learning curve and hopefully we've done that today.

0 Comments

Leave a Reply. |

Words

The DYOJO - helping contractors shorten Archives

June 2024

Categories

All

EstimatingMarketingInsurance ClaimsLeadership |

|

| |||||||

RSS Feed

RSS Feed