|

During a recent three minute video, that I recorded while I was taking a walk, I discussed some thoughts on the topic of labor supervisory hours for insurance claims. Most of my comments were geared towards the repairs or reconstruction side of the insurance claims process, but the principles apply to water and fire damage mitigation as well. Supervisory Labor for ConstructionIn the construction realm, supervisory labor (i.e. project management time) is something that is regularly charged for, but it is embedded in the lump sum pricing. When a consumer hires a contractor to remodel their kitchen, they likely will receive a one page document that says,

This is lump sum pricing and it's common. There is nothing out of the ordinary or wrong with this pricing model or estimating presentation. Project Management Time for Insurance ClaimsFor the typical insurance claim, carriers prefer to see estimates itemized in what's referred to as unit or standardized pricing. Often an estimating program called Xactimate is utilized to create these estimates. In this format, the scope and pricing are presented as line items. The bid is build line by line and room by room. In unit, or standardized pricing, those items like supervisory labor, overhead, and profit are not embedded in the cost. Supervisory is separated out as an additional line item while overhead and profit are factored as markups at the end of the estimate similar to the way sales tax is accounted for. Again, in construction, these charges are normal but they are presented in a different manner. For an insurance project, since they are listed separately, it gives the impression that they are up for discussion or optional; this is not the case. The charges are common, but the format is not. It's important for the consumer and the contractor to understand these unique elements when working through an insurance claim. Project Management is a Direct CostSupervisory labor, or project management time, is the primary focus of this article. Even contractors misunderstand that this element is not an overhead cost, it is a direct cost of the project. Overhead costs are considered indirect costs. These are real costs for every construction business but they are are aspects of business that are not specifically attributed directly to the individual job. Examples of indirect costs (aka general overhead) might include your business licensing, company insurance, office rental, administrative labor, utilities, etc. All items that must be accounted for or the company will not be able to pay their bills and won't be in business for long. On the other hand, supervisory labor includes the direct costs of having a representative on the work site, meeting with the client, lining out the project, making sure materials are properly ordered, and that the work is progressing along it's key intervals. These are direct costs. The company pays for their managers, supervisors, foreman, and safety personnel to be onsite. These costs should be charged for and not lumped into general overhead. Charging for Project ManagementSupervisory labor is a direct cost that should be accounted for and approved on the front end. It is common to factor supervisory as a percentage of the total estimated hours or to be tallied and charged at the end of the project. The charges and factor should be agreed to in writing at the project outset. On a large project, it is recommended to send regularly updates on the hours applied so that the total hours and charges are not a surprise to all parties at project completion.

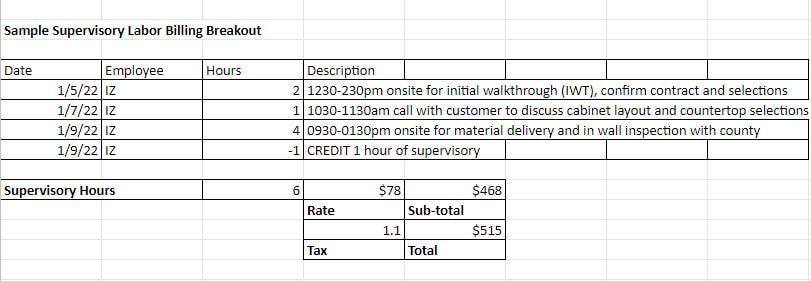

An example of how a contractor would present their charges for project management, including any applicable credits, might look like this:

0 Comments

Leave a Reply. |

Words

The DYOJO - helping contractors shorten Archives

June 2024

Categories

All

EstimatingMarketingInsurance ClaimsLeadership |

|

| |||||||

RSS Feed

RSS Feed